Partner Article

Nick Hood’s Company Of The Month

Kilfrost: a North East success story in tough times

Judging the financial health of a company is about more than top line sales and even bottom line profits. There needs to be sufficient working capital, particularly cash resources or bank facilities. General balance sheet strength to support trading is vital, especially when a business is growing.

These past few years since the start of the global recession have been particularly tough, not just because so many markets have been badly affected by the crisis, but because this time round it has hit the UK financial system harder than any recession in modern times. The result has been a squeeze on the lending capacity of banks and other financial institutions. But worse still, it has adversely affected, maybe permanently, the attitude of bankers to risk.

Many businesses have faltered, especially in the UK regions. So it’s great to find a company based in Newcastle, bucking the trend and staging a financial recovery from a more vulnerable position just before the financial sky fell in on the commercial world.

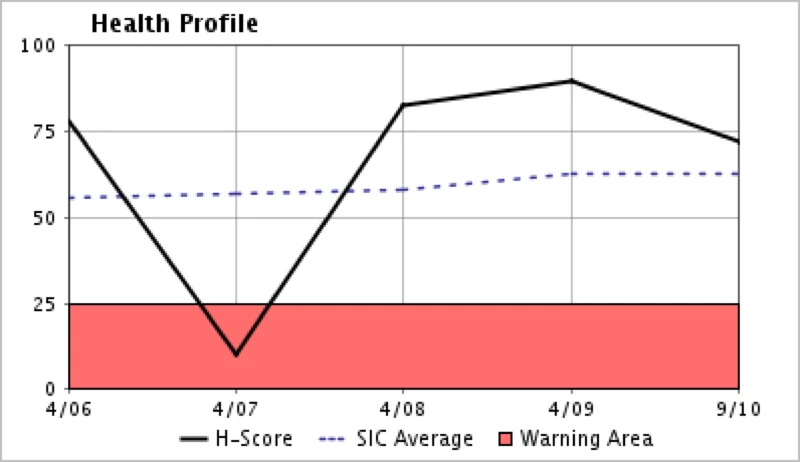

Kilfrost, which is a de-icing and anti-icing product manufacturer specialising in the transport and aviation sectors which have been under severe pressure these past few years, has climbed from the depths of our Company Watch warning area in 2007 to a strong position after its September 2010 accounts, the latest available for analysis.

Company Watch judges businesses on their published accounts after crunching their numbers through a sophisticated mathematical model, which examines seven key financial ratios and compares the results with other firms of similar size in their commercial sector. The outcome is the H-Score®, a financial health rating out of a maximum of 100. Clients use this data both for credit risk management and for monitoring supply chain disturbance risk.

Kilfrost’s accounts for April 2007 produced a lowly H-Score of just 10, firmly in the Warning Area of firms with scores below 25. One in four of companies in this zone go on to file for insolvency or undergo a major restructuring. Its net worth was just £3.4m and it made a pre-tax loss that year of £1.4m. The balance sheet showed critical signs of weakness, leading to clear vulnerability. One poor year’s trading had reversed the previous H-Score of 76.

Both the net worth and the profits of Kilfrost have risen steadily since then, so that the net assets were £7.1m by September 2010 and it declared pre-tax profits of £4m on sales of nearly £45m in the 17 months to that date. The result is a healthy H-Score of 72 and a good profile on almost all of the seven key financial ratios.

It will be interesting to see the picture when Kilfrost’s 2011 accounts are available. The lesson of the sharp setback in 2006/7 is that management teams can take nothing for granted, especially in these exceptionally challenging times in the UK economy. But let’s hope that this regional success story continues.

This was posted in Bdaily's Members' News section by Nick Hood .

Enjoy the read? Get Bdaily delivered.

Sign up to receive our daily bulletin, sent to your inbox, for free.

The real cost of tendering for construction SMEs

The real cost of tendering for construction SMEs

A welcome step forward – but let’s keep pushing

A welcome step forward – but let’s keep pushing

Industrial strategy 'can drive business forward'

Industrial strategy 'can drive business forward'

Industrial strategy 'can be game-changer we need'

Industrial strategy 'can be game-changer we need'

Driving skills forward with near £100,000 boost

Driving skills forward with near £100,000 boost

What pension rule changes could mean for you

What pension rule changes could mean for you

North East can't be an afterthought in AI future

North East can't be an afterthought in AI future

Understanding the impact of the Procurement Act

Understanding the impact of the Procurement Act

Is the UK losing ground in life sciences investment?

Is the UK losing ground in life sciences investment?

Construction workforce growth can't be a quick fix

Construction workforce growth can't be a quick fix

Why it is time to give care work a makeover

Why it is time to give care work a makeover

B Corp is a commitment, not a one-time win

B Corp is a commitment, not a one-time win