Partner Article

British Business Bank provides £40m extension to Funding Circle lending

The government-backed investment firm, British Business Bank, has announced an eight-figure expansion to its lending efforts on direct lending platform Funding Circle.

Following on from the £60m that the British Business Bank has provided to more than 10,000 UK businesses, the development bank will today begin lending a further £40m to the country’s small business community.

According to the bank, its efforts on the platform have so far created an estimated 30,000 new jobs, while obtaining around £5m in cumulative net interest for the taxpayer and has helped to establish alternative finance as a mainstream source of business funding.

Catherine Lewis La Torre, CEO of British Business Bank Investments Ltd, described so-called, ‘AltFi’, as an increasingly important source of business finance with an 85% increase in alternative lending between 2014 and 2015.

She added: “A key part of our remit is to support the development and growth of such finance markets, while earning an attractive, commercial return for the taxpayer. We look forward to seeing our latest commitment to Funding Circle enabling the growth and success of many more businesses across the UK.”

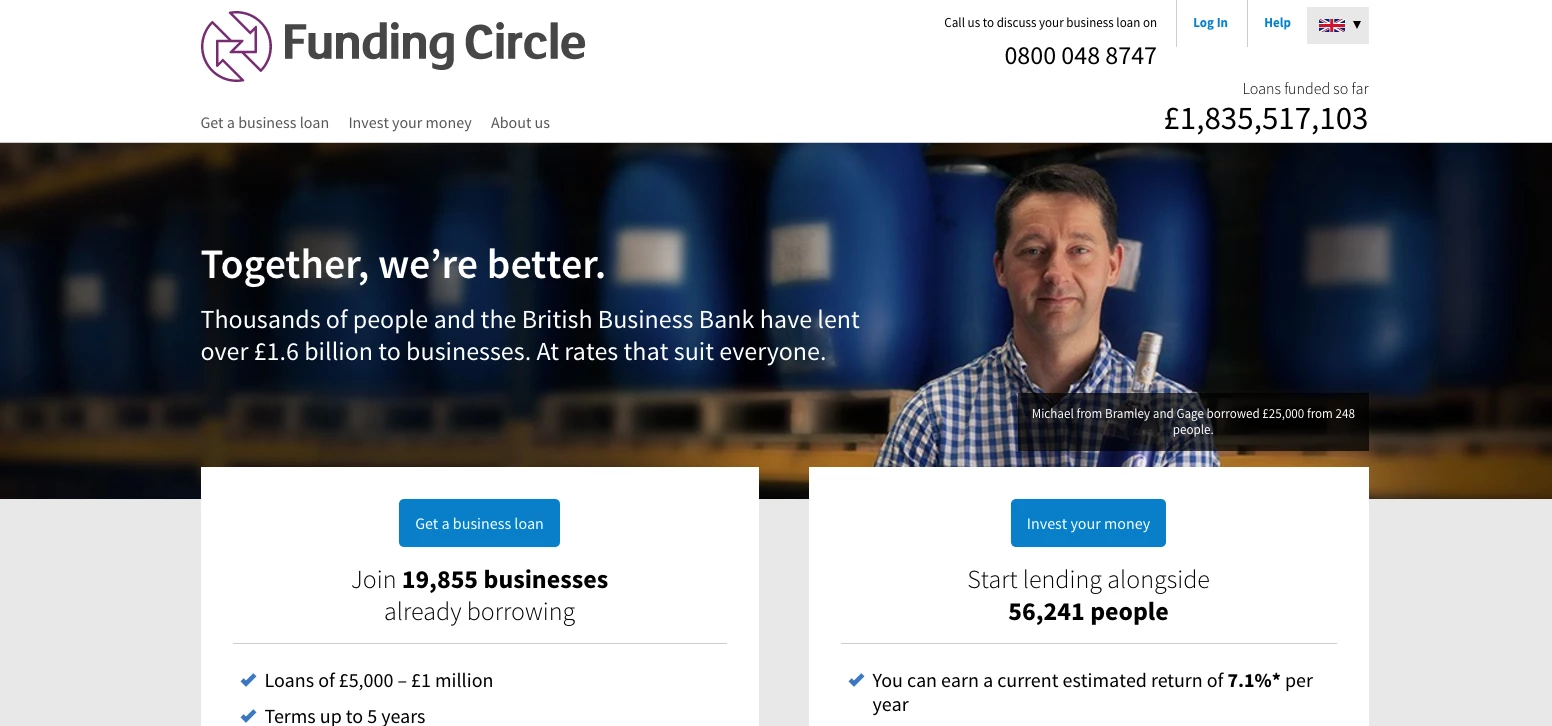

Bringing together a raft of different lenders including investors, local authorities and financial institutions, Funding Circle provides small businesses with a source of direct funding while offering investors returns of over 7% on its peer-to-peer (P2P) lending platform.

James Meekings, Co-Founder and UK Managing Director of Funding Circle commented: “This further lending commitment is recognition of the success of the partnership to date and we look forward to working with the British Business Bank to help thousands more small businesses.”

Looking to promote your product/service to SME businesses in your region? Find out how Bdaily can help →

Enjoy the read? Get Bdaily delivered.

Sign up to receive our popular morning London email for free.

£100,000 milestone drives forward STEM work

£100,000 milestone drives forward STEM work

Restoring confidence for the economic road ahead

Restoring confidence for the economic road ahead

Ready to scale? Buy-and-build offers opportunity

Ready to scale? Buy-and-build offers opportunity

When will our regional economy grow?

When will our regional economy grow?

Creating a thriving North East construction sector

Creating a thriving North East construction sector

Why investors are still backing the North East

Why investors are still backing the North East

Time to stop risking Britain’s family businesses

Time to stop risking Britain’s family businesses

A year of growth, collaboration and impact

A year of growth, collaboration and impact

2000 reasons for North East business positivity

2000 reasons for North East business positivity

How to make your growth strategy deliver in 2026

How to make your growth strategy deliver in 2026

Powering a new wave of regional screen indies

Powering a new wave of regional screen indies

A new year and a new outlook for property scene

A new year and a new outlook for property scene