Partner Article

Islington Associates Zurich Switzerland: These Five Currencies Are Most Exposed to Emerging-Market Rout

Derivative traders are hedging their bets on five emerging markets where they see the greatest probability of declines in the next month.

The currencies of Turkey, Brazil, Mexico, Russia and South Africa are seeing the world’s biggest increases in their implied volatility gauges this quarter, amid the worst period for developing-nation currencies since China’s shock devaluation in the third quarter of 2015.

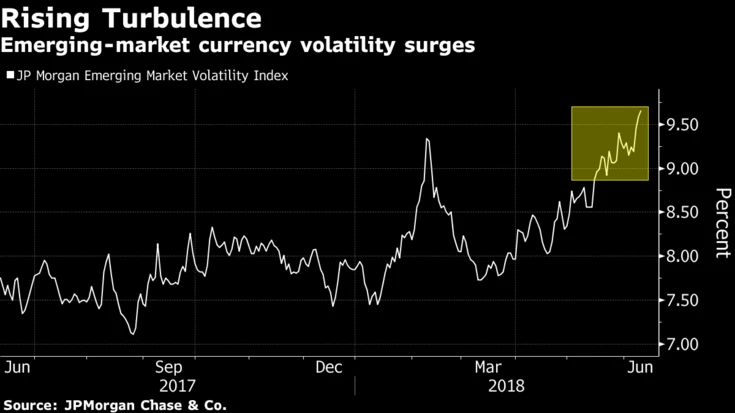

Options traders’ expectations for swings in emerging-market currencies have risen to the highest level since March 2017, sending a volatility gauge by JPMorgan Chase & Co. to its worst first half since 2013. Most of the increase has come from currencies in Latin America, Emerging Europe, the Middle East and Africa.

This was posted in Bdaily's Members' News section by Krystal Kim .

£100,000 milestone drives forward STEM work

£100,000 milestone drives forward STEM work

Restoring confidence for the economic road ahead

Restoring confidence for the economic road ahead

Ready to scale? Buy-and-build offers opportunity

Ready to scale? Buy-and-build offers opportunity

When will our regional economy grow?

When will our regional economy grow?

Creating a thriving North East construction sector

Creating a thriving North East construction sector

Why investors are still backing the North East

Why investors are still backing the North East

Time to stop risking Britain’s family businesses

Time to stop risking Britain’s family businesses

A year of growth, collaboration and impact

A year of growth, collaboration and impact

2000 reasons for North East business positivity

2000 reasons for North East business positivity

How to make your growth strategy deliver in 2026

How to make your growth strategy deliver in 2026

Powering a new wave of regional screen indies

Powering a new wave of regional screen indies

A new year and a new outlook for property scene

A new year and a new outlook for property scene