Partner Article

What the UK needs to do to supercharge highway electrification

With National Drive Electric Week 2023 underway this week, to raise awareness of all or part-electric and plug-in vehicles, Julian Skidmore, Senior Firmware Engineer from smart charging consultancy, Versinetic, shares his thoughts on the Prime Minister’s recent u-turn on 2030 net zero targets from an EV perspective and also discusses in this article, how the UK EV market ranks against its European counterparts.

The changes this summer to the EV charging infrastructure policies were largely punitive for EV charging companies without really providing any more support for what the industry needs (regulations that improve standards without development and production overheads) nor what customers need (reliability and ease of use).

The Net Zero policy changes, whilst being disappointing, will only affect plug-in hybrids (PHEVs) and their market will be insignificant by 2030. That’s because by then full EVs (BEVs) will have grown from 20.1% (August 2023) to more than 95% of the entire new car market (a simple consequence of adoption curves and ongoing technology disruption).

As a consequence, the pressure on charging infrastructure will remain. More serious was the government’s antipathy towards car-sharing, which if incentivised properly, could significantly reduce congestion, costs and emissions for ordinary Brits in the next decade until EVs reach a majority of cars on the road.

In the UK, we have seen phenomenal growth in the new EV market over the past few years. As of the end of July 2023, there are now around 840,000 fully electric cars on UK roads and a further 520,000 plug-in hybrids. More than 265,000 battery-electric cars were registered in 2022, a growth of 40% on 2021.

Nevertheless, EV adoption in the UK is in the middle of the pack if we measure by percent adoption against other countries in Europe, or about 3rd if we measure by absolute sales numbers[1].

The question we’d like to explore in this article is why we aren’t further up the percentage table. It’s evident that Scandinavian countries (especially Norway) lead impressively. Yet, intuitively, we might think adoption would struggle there, because batteries function much less well in cold climates.

Compared to EV adoption in Norway and Sweden, UK adoption rates are approximately in line with what’s happening in these countries. However, what we would like is to be more competitive rather than being average. What will it take for the UK to lead?

It also means a cleaner, greener planet which in turn will slow changes in the climate and this will have a positive, knock-on impact across the world and societies as a whole.

So, all of these things are positive, from a prestige, practical and long-term viewpoint. In order for us to understand what must happen for the UK to lead, we must ask what it is about Scandinavian countries like Norway and other countries that means they’re at the top right now?

For the purposes of this this article, we’ll mostly concentrate on Battery Electric Vehicles, rather than Plug-in Hybrid Electric Vehicles (PHEVs), because these are the only means of fully decarbonising transport by the 2050 timeframe and we can see in Norway’s figures that the PHEV market is already being squeezed.

Does Net Zero status = increased EV adoption

At Versinetic, our engineers spent quite a bit of time considering a number of the obvious reasons why EV adoption might be favoured in one country or another.

For example, we might think that a primary driver is renewable or zero carbon energy. Norway, for example, is about 98% renewable[2]. And Sweden has over 80% renewable or nuclear electricity[3] with Wind power increasing rapidly. So clearly, it is a factor.

The problem is that when we look at other countries in Europe, the correlation starts to break down.

France is 93% zero carbon (better than Sweden), but has an EV adoption rate similar to the UK[4].

Consider, the Netherlands, also near the middle of the EV adoption table, they’re #14, just below the UK, but astoundingly it’s near the bottom for zero carbon energy in the EU27[5].

Looking at Lithuania, it’s at the bottom for EV adoption, but is 7th in terms of zero carbon energy.

EV adoption and government incentives

Another possibility is that EV adoption is driven by government incentives. And it’s true that governments across the EU have provided incentives in various forms.

Sometimes, they do make a difference. For example, when the UK government cut incentives for PHEVs from £2.5K per car to zero, the market quickly shifted from being PHEV-dominated to being BEV-dominated. In that sense, it was a good thing because a large number of company PHEVs were being bought for the grant, but without domestic chargers being installed - resulting in PHEVs which emitted more CO2 than an equivalent combustion car. The archetypal fake-EVs as described by Transport & Environment[6].

The trouble here, though, is that most of the incentives across Europe, and particularly across the EU, are very similar. Purchase grants are generally around €4K to €6K; vehicle tax is waived and parking costs are sometimes cut or halved[7].

In addition, a number of states have introduced penalties for buying or driving combustion cars, a principle called Bonus Malus or “Polluter Pays”. The UK can be included here, due to additional vehicle tax for high-polluting cars and its carbon tax for fuels.

It’s likely though that at least in the UK, the need for such government incentives is reducing; as BEVs have become more cost competitive with combustion cars (and particularly plugless hybrid cars); as well as PCP purchasing schemes whose monthly costs now overlap with comparable combustion cars; and an emphasis on Total Cost of Ownership.

This possibly explains why although the UK has continued to reduce its BEV incentives (now £2.5K/car up to cars costing £35K), it hasn’t fallen further behind in terms of plug-in market share and the market still appears to be growing exponentially.

This is encouraging, because although the EV market does need support against the incumbent combustion engine industry, if the EV market continued to be primarily dependent on government grants it would imply a lack of long-term viability, perhaps because people (or states) didn’t care about the environment or because the technological benefits weren’t sufficient.

EV adoption and government CO2 targets

The EU is setting increasingly tough targets for vehicle CO2 emissions, and this has certainly driven higher plug-in adoption rates across Europe.

CO2 emissions targets are aimed at manufacturers rather than countries. However, from a manufacturer’s viewpoint this is likely to mean a greater push from automakers to countries with the largest potential EV markets.

And basically that means Germany, France and the UK. We can already see that in the current figures.

Although the UK is about 13/30 for Plug-in EV adoption (just behind France and really lagging behind Germany in 6th place); it’s 10th in terms of combined CO2 emissions of new cars (2 places ahead of France, with Germany in 5th place); 7th in terms of BEVs (just ahead of France with Germany in 4th) we are second in terms of absolute number of BEV sales, (with Germany in 1st place and France in 3rd).

This means that if manufacturers want to reduce their CO2 emissions as much as possible by picking the low-hanging fruit (and they do, because the EU is enforcing it), they will take their focus off Norway (because their market can only grow by 100%, i.e. 19K BEVs) and concentrate on the biggest markets - namely Germany, France and the UK.

In that sense, even though we are no longer members of the EU, we are still as central to EU emissions goals as we ever were. It means that the UK is likely to rise up all these other charts thanks to the EU.

What is the biggest influence on EV adoption?

We might think that the biggest influence on EV adoption is average GDP: the star players of Europe buying the most electric vehicles, because EVs have been expensive.

It’s true there is a general trend towards higher EV adoption and GDP. However, there are a number of outliers, such as Luxembourg and Ireland, with high GDP and low adoptions; or Bulgaria and Portugal which have a low GDP, but relatively high EV adoption.

As EVs reach price parity with other technologies, combustion vehicles start to lose their economy of scale. Counter-intuitively, fuel prices will continue to go up even as demand falls against supply, because of the maintenance cost of existing supply lines and equipment will become increasingly dominant.

This makes EVs increasingly competitive and, consequently, GDP less of an issue. There is an entertaining Bloomberg video from 2016[8] about a related oil glut effect to that of 2014, notable for its prediction about 500,000 Tesla sales by the end of 2020 (Tesla hit just over 500,000) and at around 3:08 it asks us to imagine a future where “the rumbling streets of New York and New Delhi” suddenly fall silent. Given the experiences of the past year, this is no longer even hard to imagine (for different reasons).

Surprisingly, it turns out that charge points themselves provide a really effective metric for EV adoption. This was discovered by one of our engineers by chance whilst reading a T&G paper[9] on European EV infrastructure.

Now, the T&G paper focuses on the EU directive on EVs per charging point, but from the viewpoint of this article, the number of charging points per capita is more interesting.

And that’s primarily because the population as a whole won’t be able to tell what the relationship between the number of EVs and charging points is (until they start to see large queues of EVs at charging points), but they can tell how many charging points there are in their environment.

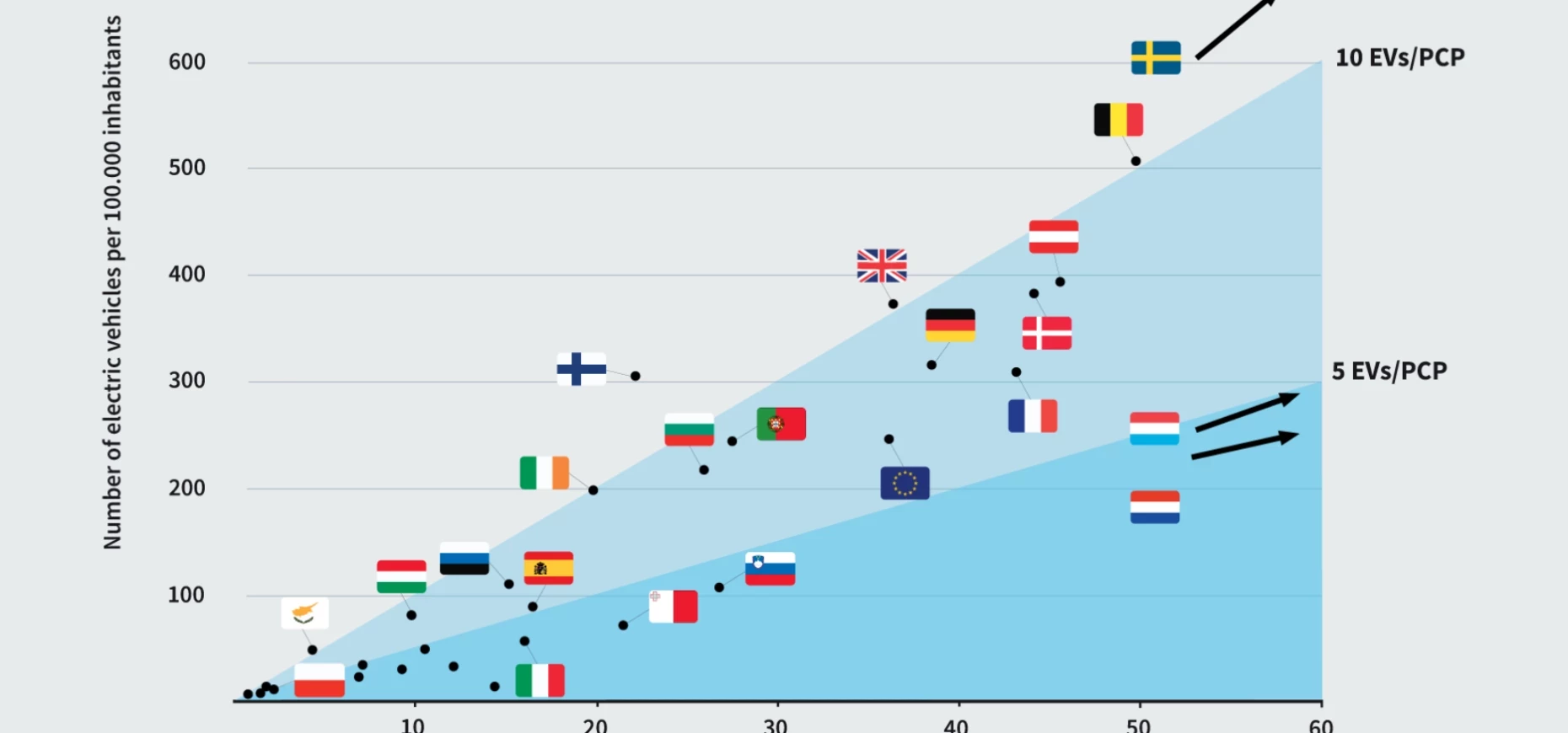

The sheer familiarity of EV infrastructure normalises expectations of electric vehicles, driving the market. Let’s look at the graphic from T&E reproduced in the article.

The UK is somewhere in the middle-right of the x-axis; pretty close to Germany and France, with the number of charging points generally tracking EV adoption.

What’s more interesting, though, is when we look at certain leading nations.

Norway has 32.4 EVs per public charging point. It is way off the graph, but if it was represented, it would look dreadful. But it also has a phenomenal 294 charging points per 100K inhabitants.

Sweden has similar properties, it’s off the graph when it comes to both EVs per Public Charging point and also charging points per head of population.

And again, another outlier, Portugal, which is a relatively low-income EU country, but has a high number of charging points per 100,000 inhabitants, just below the UK.

Tactics to up adoption of EVs in Europe

EV adoption in Europe is full of surprises alongside some predictable moves and strategies.

To some degree, all of the influences we might expect, do, in fact, make a difference to how well an individual country can adopt EVs. Renewable and zero carbon energy does make a difference. We can deduce that coal dominated countries like Poland would benefit from lower emissions strategies. At the same time, unlike Norway, we don’t have such an easily exploitable natural source of electricity and it will take quite a while for the UK’s renewable resources to reach their potential (because they’ll reflect the shift in how we use all our energy, rather than the rate of EV adoption).

Other tactics make a significant difference too, such as government incentives and EU emissions directives. Lobbying these large-scale organisations can and will keep up the pressure to transform transport. This is good - and essential - since they expect to be informed of industry and citizen aspirations. It turns out, however, that throughout Europe, these measures are broadly similar for governments across the political spectrum, therefore it’s unlikely that the UK’s position will be hugely affected by these means.

Similarly, although a country’s wealth does have an effect on EV adoption, there’s not likely to be a huge shift in the short-term in our relative GDP - the Brexit effect notwithstanding - and the increasing competitiveness and sales models for EVs will, we anticipate, start to erode these advantages in the near term.

However, there is one thing that does stand out as a mechanism that communities, municipalities and businesses can exploit as a means of increasing EV adoption; the take-up of EV charging points.

Fundamentally, the presence of charging points normalises the acceptance of EVs and displaces anxiety about range, so the recent legislation to increase the number of charge points is very significant indeed. In the long-term, it also leads to cheaper EVs in a wider range of market segments. If the UK is to keep up with the acceleration of EVs particularly following the legislation, it would be advisable to follow suit and focus on increasing charging points as a priority.

References Unless otherwise stated, sources are online

[1] EV stats, Zap Map [2] Renewable energy in Norway, Regjeringen website How the UK transformed its electricity supply in just a decade, Interactive Carbon Brief [3] Energy use in Sweden, Sweden government website [4] Electricity sector in France, Wikipedia [5] Renewable energy in the Netherlands, Wikipedia Electric cars rise to record 54% market share in Norway in 2020, Reuters [6] Plug-in hybrids in new emissions scandal as tests show higher pollution than claimed, Transport & Environment Incentives for Electric Vehicles, Versinetic [7]Norwegian EV policy, Elbil Austria EV incentives, Wallbox blog EV incentives and city bans, Fleeteurope Lithuania backs purchase of electric cars with considerable subsidy, BNN Romania double 2021 EV subsidy budget, Evectrive EV incentives to drive demand in Europe, Argus Media Polish government’s electric vehicle subsidies fail to attract applications, Notes from Poland Slovakia subsidies plug-in electric vehicles, Electrive Czech Republic incentives, EAFO Europe website Cyprus expands incentive scheme for electric cars, vehicle replacement, Balkan Green Energy News Eco fund reduces subsidies for electric vehicles, Slovenia Times The peak oil myth and the rise of the electric car, Bloomberg Recharge EU, Transport & Environment CO2 targets propel Europe to 1st place in emobility race, Transport & Environment

This was posted in Bdaily's Members' News section by Versinetic .

Enjoy the read? Get Bdaily delivered.

Sign up to receive our popular morning National email for free.

Raising the bar to boost North East growth

Raising the bar to boost North East growth

Navigating the messy middle of business growth

Navigating the messy middle of business growth

We must make it easier to hire young people

We must make it easier to hire young people

Why community-based care is key to NHS' future

Why community-based care is key to NHS' future

Culture, confidence and creativity in the North East

Culture, confidence and creativity in the North East

Putting in the groundwork to boost skills

Putting in the groundwork to boost skills

£100,000 milestone drives forward STEM work

£100,000 milestone drives forward STEM work

Restoring confidence for the economic road ahead

Restoring confidence for the economic road ahead

Ready to scale? Buy-and-build offers opportunity

Ready to scale? Buy-and-build offers opportunity

When will our regional economy grow?

When will our regional economy grow?

Creating a thriving North East construction sector

Creating a thriving North East construction sector

Why investors are still backing the North East

Why investors are still backing the North East