The Autumn Statement: Nine hopes and expectations shared by industry experts

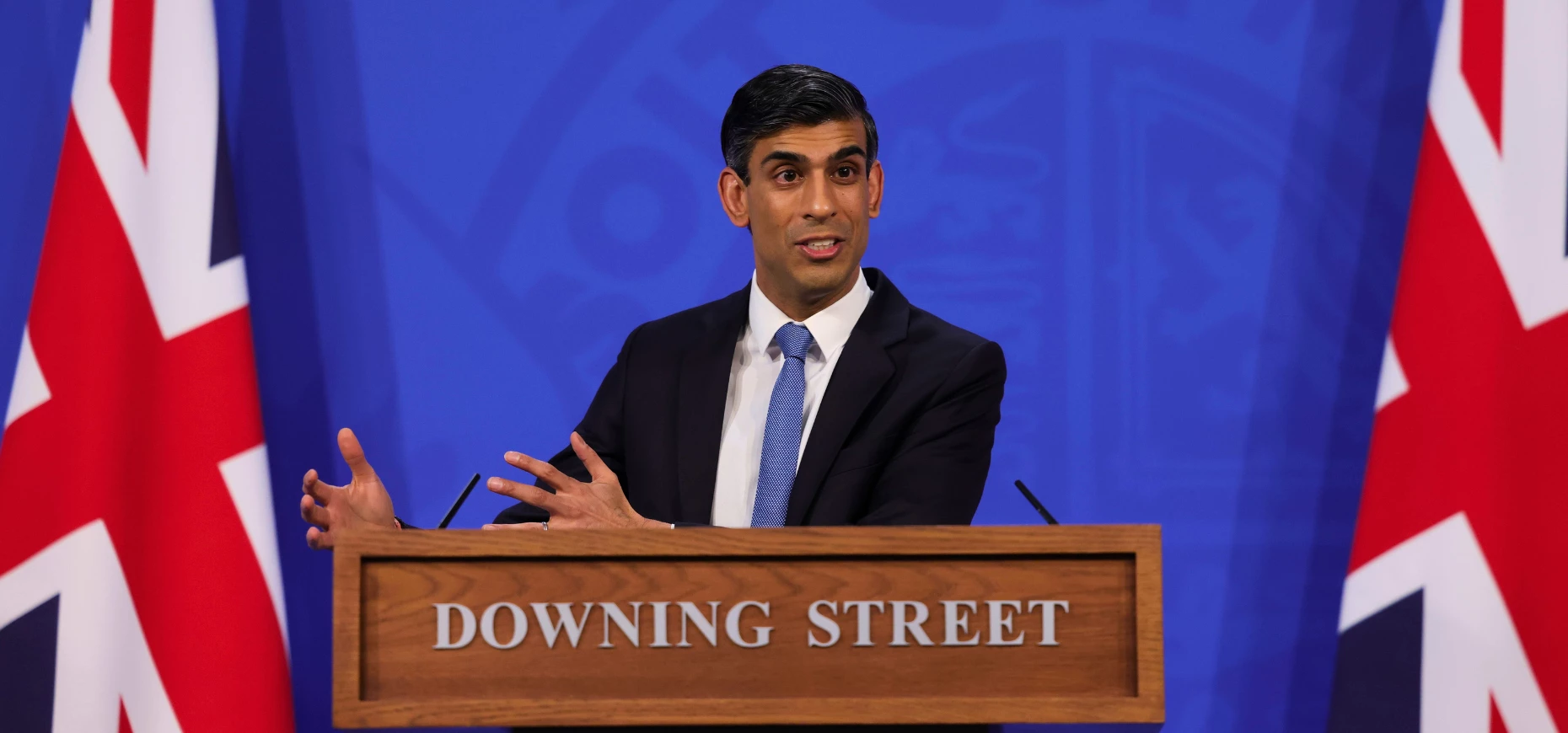

Amid today’s (13 November) cabinet reshuffle, some have begun to make their predictions as to the kind of announcements that the government will make in its Autumn Statement on 22 November.

Financial services company Hargreaves Lansdown has identified nine changes that could be announced in the Autumn Statement, which might affect our personal finances.

Sarah Coles, head of personal finance, Hargreaves Lansdown, commented: “As we round the corner on the final straight towards the Autumn Statement, the rumour mill is in overdrive. We’re yet to see any firm policies pre-announced, but there have been plenty of suggestions raised, and reports of potential announcements.

“ISA changes have been widely debated, and this is a real opportunity to polish a cornerstone of people’s savings and investments. Unfortunately, we’ve seen some signs that Jeremy Hunt may have rejected some key suggestions already, but there are a number of other possibilities which could help change people’s financial lives for the better.”

Helen Morrissey, head of retirement analysis at Hargreaves Lansdown, added: “The recent King’s Speech was a damp squib when it came to pensions. We had been expecting a series of measures aimed at moving the government’s Mansion House reforms forward, but they were noticeably absent.

“However, we may still see movement on these issues in the Autumn Statement, for instance measures aimed at encouraging schemes to invest in more productive assets. We could also see more detail on the removal of the lifetime allowance and tax treatment of death benefits from a pension.”

According to Sarah Coles, the rumour mill expects:

-

“One suggestion that has apparently received support from the Treasury is allowing people to hold more than one type of the same sort of ISA in each tax year.

-

It has been reported that some of the bigger changes to ISAs might be brought into a consultation on wider ISA reform, to enable the government and the industry to explore the implications. It gives them the scope to consider some really ground-breaking changes.

-

There may also be a move to address the fact that fractional shares can’t be held in an ISA to protect them from tax. The emergence of fractional shares post-dates the ISA regulations, so the government could decide it’s time to consider the position of fractional shares.

-

There could be movement on long term asset funds now the FCA has set out the conditions for distribution to the retail market. At the moment, they can’t be held within an ISA, because ISA assets need to have the ability to be sold within 30 days.

-

On balance, the likelihood of tax cuts in the statement appears to have risen very slightly. They had been expected to be postponed for a ‘doozy’ of a Budget in the spring. However, the Office for Budget Responsibility said ‘fiscal headroom’ has grown to between £13bn and £15bn, opening the opportunity for more spending or tax cuts.

-

Tougher benefits rules could be brought in for people who are too sick to work. The government has already said it will remove the work capability assessment, which allows a benefit top up if people are too ill to work.

-

Plans to offer first time buyers more mortgage support are likely to be delayed until the spring. The current mortgage guarantee scheme, which helps buyers with a 5% deposit, is set to run into December.

-

Alcohol duty is expected to rise again with RPI inflation, pushing the price of an average bottle of red wine to £8.

-

There were reports that Jeremy Hunt was under pressure to raise fuel duty for the first time in a decade. A 2p rise would put fuel duty alone at 55p a litre.“

By Matthew Neville – Senior Correspondent, Bdaily

- Add me on LinkedIn and Twitter to keep up to date

- And follow Bdaily on Facebook, Twitter and LinkedIn

- Submit press releases to editor@bdaily.co.uk for consideration.

Looking to promote your product/service to SME businesses in your region? Find out how Bdaily can help →

Enjoy the read? Get Bdaily delivered.

Sign up to receive our popular morning National email for free.

£100,000 milestone drives forward STEM work

£100,000 milestone drives forward STEM work

Restoring confidence for the economic road ahead

Restoring confidence for the economic road ahead

Ready to scale? Buy-and-build offers opportunity

Ready to scale? Buy-and-build offers opportunity

When will our regional economy grow?

When will our regional economy grow?

Creating a thriving North East construction sector

Creating a thriving North East construction sector

Why investors are still backing the North East

Why investors are still backing the North East

Time to stop risking Britain’s family businesses

Time to stop risking Britain’s family businesses

A year of growth, collaboration and impact

A year of growth, collaboration and impact

2000 reasons for North East business positivity

2000 reasons for North East business positivity

How to make your growth strategy deliver in 2026

How to make your growth strategy deliver in 2026

Powering a new wave of regional screen indies

Powering a new wave of regional screen indies

A new year and a new outlook for property scene

A new year and a new outlook for property scene