Partner Article

University of Manchester reveal £300m bond offering

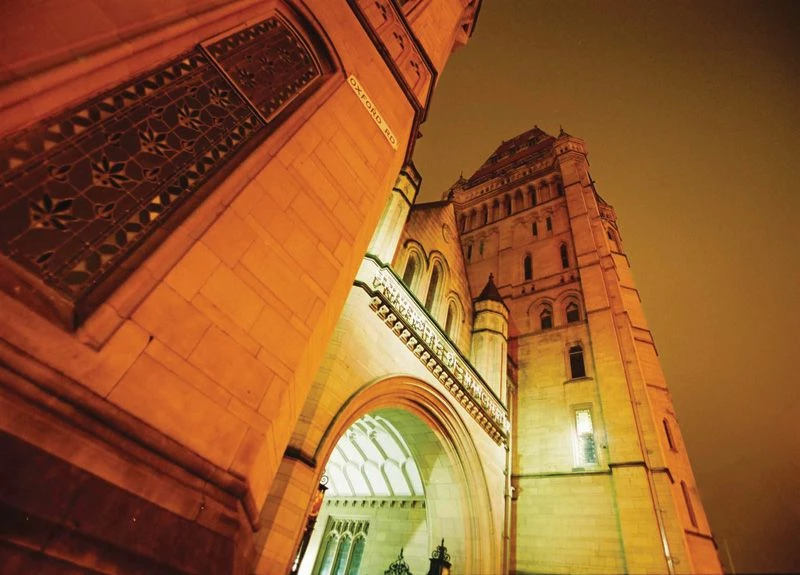

The University of Manchester has released £300m 4.25% bonds due 2053, which it will use to continue its £1bn campus overhaul plans.

The bonds, which have been given a Aa1 rating by investors service, Moody’s, will also be used by the University for general corporate purposes.

Moody’s priced the bonds at a spread of 0.8% over the relevant reference gilt, while Barclays, HSBC and The Royal Bank of Scotland acted as Joint Bookrunners.

Professor Dame Nancy Rothwell, President and Vice-Chancellor of The University of Manchester, said: “We are delighted by the success of this issue, and by the strong support shown by investors in the University and its mission.

“The proceeds will allow us to further our ambition to be a truly world-class university by delivering a single, outstanding campus for The University of Manchester, with our beautiful old buildings standing alongside the very best modern facilities for our research and our students.”

The National Australia Bank acted as co-manager while Rothchild provided independent debt advice to Manchester.

This was posted in Bdaily's Members' News section by Miranda Dobson .

Ready to scale? Buy-and-build offers opportunity

Ready to scale? Buy-and-build offers opportunity

When will our regional economy grow?

When will our regional economy grow?

Creating a thriving North East construction sector

Creating a thriving North East construction sector

Why investors are still backing the North East

Why investors are still backing the North East

Time to stop risking Britain’s family businesses

Time to stop risking Britain’s family businesses

A year of growth, collaboration and impact

A year of growth, collaboration and impact

2000 reasons for North East business positivity

2000 reasons for North East business positivity

How to make your growth strategy deliver in 2026

How to make your growth strategy deliver in 2026

Powering a new wave of regional screen indies

Powering a new wave of regional screen indies

A new year and a new outlook for property scene

A new year and a new outlook for property scene

Zero per cent - but maximum brand exposure

Zero per cent - but maximum brand exposure

We don’t talk about money stress enough

We don’t talk about money stress enough